The Estate Planning Attorney Ideas

The Estate Planning Attorney Ideas

Blog Article

Some Known Details About Estate Planning Attorney

Table of ContentsEstate Planning Attorney for BeginnersThe Ultimate Guide To Estate Planning AttorneyThe Best Guide To Estate Planning AttorneyExcitement About Estate Planning Attorney

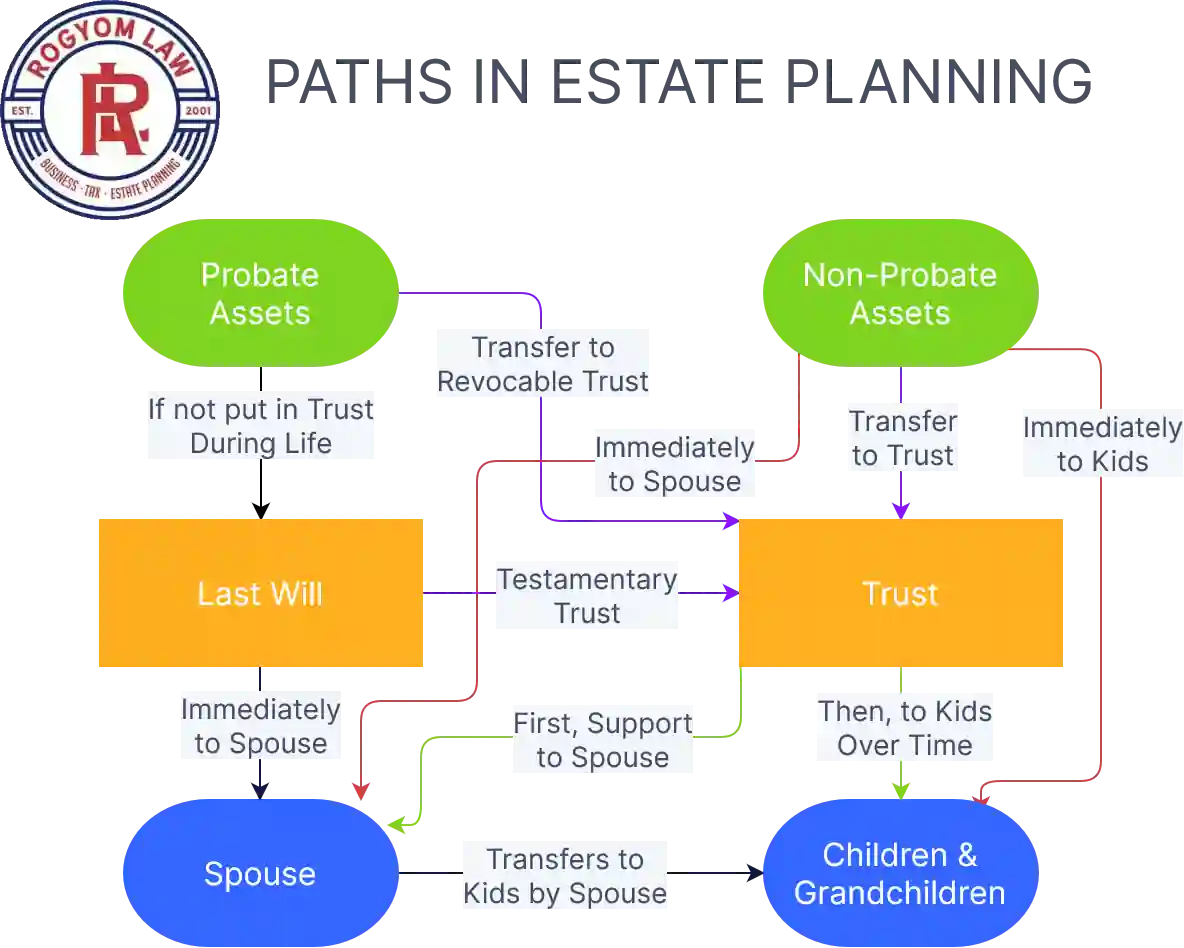

Estate planning is an activity strategy you can utilize to identify what occurs to your possessions and obligations while you're active and after you pass away. A will, on the other hand, is a legal record that lays out exactly how properties are distributed, who deals with youngsters and pet dogs, and any kind of other desires after you die.

The administrator also needs to pay off any type of tax obligations and financial obligation owed by the deceased from the estate. Lenders normally have a limited amount of time from the date they were informed of the testator's death to make cases against the estate for money owed to them. Cases that are declined by the administrator can be brought to justice where a probate judge will have the last word as to whether or not the case is valid.

Estate Planning Attorney for Beginners

After the inventory of the estate has actually been taken, the worth of possessions calculated, and tax obligations and financial debt paid off, the executor will certainly then look for consent from the court to disperse whatever is left of the estate to the beneficiaries. Any estate taxes that are pending will come due within nine months of the day of fatality.

Each individual locations their possessions in the trust fund and names a person aside from their spouse as the beneficiary. A-B trust funds have actually become less popular as the estate tax exemption works well for many estates. Grandparents may transfer possessions to an entity, such as a 529 plan, to support grandchildrens' education.

Estate Planning Attorney - An Overview

This approach includes cold the value of a property at its value on the Get More Info day of transfer. Accordingly, the amount of possible capital gain at fatality is also frozen, permitting the estate planner to approximate their potential tax responsibility upon death and much better prepare for the payment of earnings tax obligations.

If sufficient insurance policy proceeds are offered and the plans are view it properly structured, any kind of income tax obligation on the regarded dispositions of assets complying with the fatality of an individual can be paid without resorting to the sale of possessions. Profits from life insurance that are gotten by the recipients upon the fatality of the guaranteed are generally earnings tax-free.

There are certain documents you'll need as part of the estate planning process. Some of the most common ones include wills, powers of attorney (POAs), guardianship designations, and living wills.

There is a myth that estate preparation is just for high-net-worth people. Yet that's not real. In reality, estate preparation is a device that every person can make use of. Estate planning makes it easier for people to establish their wishes prior to and after they pass away. In contrast to what most individuals believe, it expands past what to do with assets and liabilities.

Top Guidelines Of Estate Planning Attorney

You ought to begin preparing for your estate as soon as you have any type of measurable possession base. It's an ongoing procedure: as life progresses, your estate strategy should move to match your situations, in accordance with your new objectives. And maintain it. Refraining your estate planning can trigger undue monetary burdens to liked ones.

Estate preparation is frequently taken a device for the rich. Yet that isn't the case. It can be a beneficial means for you to handle your possessions and responsibilities before and after you pass away. Estate preparation is likewise a fantastic means for you to set out prepare for the treatment of your minor kids and pet dogs and to outline your long for your funeral and preferred charities.

Eligible candidates that pass the exam will be formally licensed in August. If you're eligible to sit for the test from a previous application, you might file helpful site the short application.

Report this page